Contents:

The most popular Forex continuation chart patterns are flags, rectangles, pennants, and directional wedges. Now that you are familiar with the most popular chart patterns, start trading today with an STO account that gives you access to MT4, one of the industry’s leading forex trading platforms. There are different types of https://day-trading.info/ chart patterns available – some depict trend reversal points, signalling you to enter or exit the market immediately, while some help identifies market trends. Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure.

A double top is another pattern that traders use to highlight trend reversals. Typically, an asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets.

Overall, the advantages of chart patterns far outweigh their disadvantages. If well understood, chart patterns have the potential of generating a steady stream of lucrative trading opportunities in any market, at any given time. At AvaTrade, you can use a demo account in order to learn how to recognise chart patterns, without putting any of your trading capital at risk. Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements.

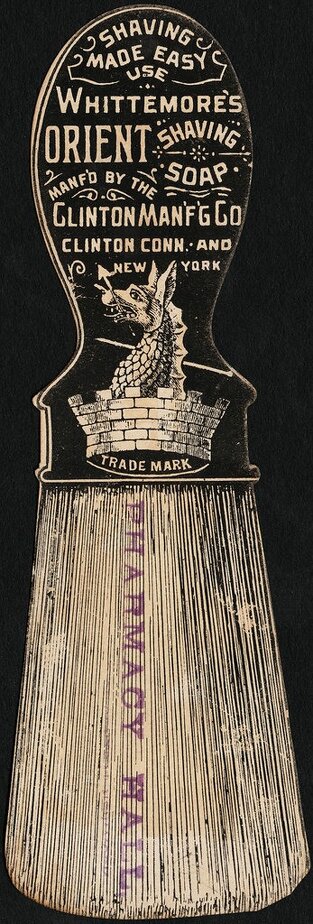

Engulfing chart pattern

A double bottom chart pattern indicates a period of selling, causing an asset’s price to drop below a level of support. It will then rise to a level of resistance, before dropping again. Finally, the trend will reverse and begin an upward motion as the market becomes more bullish. Neutral chart patterns occur in both trending and ranging markets, and they do not give any directional cue.

It always happens, bulls versus bears, but with ascending triangles, the bears are located in a very concentrated area, while bulls are buying in the development of an uptrend. The position is opened when the price breaks above the neckline after the rejection of the second bottom. Then, the profit target is set by the number of pips between the bottoms and the neckline. However, there are three popular types of Forex chart patterns that traders pay most attention to and it is therefore a good idea to focus on these.

Second place: Broadening formation trading chart pattern

Engulfing patterns represent a complete reversal of the previous day’s movement, signifying a likely breakout in either a bullish or bearish direction, depending on which pattern emerges. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal.

What is the most profitable forex pattern?

The head and shoulders patterns are statistically the most accurate of the price action patterns, reaching their projected target almost 85% of the time. The regular head and shoulders pattern is defined by two swing highs (the shoulders) with a higher high (the head) between them.

In an uptrend, a flag pattern will form when prices consolidate by forming lower highs and lower lows to signal a period of profit-taking. A break outside the upper falling trendline will be a signal that bulls are ready to drive prices higher for the next phase. They form in the shape of triangles, but they are very brief, with the resulting move duplicating the movement that preceded the formation of the pennant. In an uptrend, a bullish pennant will form when a small period of consolidation is followed by a strong desire by bulls to drive prices higher. It will be a signal that bulls are charged up for another strong push higher. The pattern looks like a candle with a very small body and very long tails .

Forex Chart Patterns

It signals that the trend, ongoing before the triangle appeared, can resume after the pattern is complete. Traders use candlestick patterns to identify trading signals – or signs of future price movements, in order to enter a trade at the right place. As I’ve already noted, the first pattern to analyze trading charts, included into technical analysis, is thought to be the Triangle pattern. The analysis of price movements started when the price chart appeared. Traders called them price patterns because the first patterns looked similar to geometric objects, like a triangle, a square, a diamond. When it became available to see the chart on a computer screen and analyze longer periods of time, new patterns started to appear.

While there are a number of chart patterns of varying complexity, there are two common chart patterns which occur regularly and provide a relatively simple method for trading. These two patterns are the head and shoulders and the triangle. All these chart patterns have a tendency for a price move equal to the size of the formation itself. It is up to you if you are going to close the head and shoulders position and then open another short position to trade the rising wedge. The other option is to stay with the head and shoulders short position until the wedge is completed. In both cases you would have generated solid profit from the head and shoulders pattern.

337 Ergebnisse für chart pattern forex in „Bilder“

The target price movement will be the size of the distance between the support and resistance lines. Similarly, if a rectangle chart pattern forms in a downtrend, traders will look to place sell orders after the horizontal support is breached. If the forex market is a jungle, then chart patterns are the ultimate trails that lead investors to trading opportunities. When trading financial assets in the forex ncaa college football news, scores, stats and fbs rankings market, profits are made out of price movements. Chart patterns are powerful tools for performing technical analysis because they represent raw price action and help traders to feel the mood and sentiment of the market. They essentially allow traders to ride the market wave, and when well understood and interpreted, they can help pick out lucrative trading opportunities with minimal risk exposure.

This is one of the most reliable chart patterns in the technical analyst’s arsenal. Head and shoulders are a reversal formation and indicate a topping reversal after a bullish trend. I will start with the reversal wedges because the previous chart patterns we discussed were the corrective wedges. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. Even though the breakout can happen in either direction, it often follows the general trend of the market.

- Resistance is where the price usually stops rising and dips back down.

- You can also apply stock chart patterns manually on your trading charts as part of our drawing tools collection.

- I hope you are very clear now on how to trade the wedge pattern.

- A rounding bottom or cup usually indicates a bullish upward trend, whereas a rounding top usually indicates a bearish downward trend.

At the high marked as in the chart above, we have a high, then at and we have nearly equal lower highs that presage a strong downwards move. It is a failed breakout, and the faster and more dramatic its failure, the better. On the contrary, the double bottom pattern has two low price valleys which predict an upward trend as buyer interest is piqued. The former happens on an upward trend and shows that even though buyers have tried to increase the price, sellers have exited at a quicker pace. The hanging man shows the peak or zenith of a price gain, showing that there is an increase in the number of sellers against buyers and therefore creating a downward shift. On the contrary, a hammer is the signal of an approaching bottom price and a speculation of the price of the pair to rise soon after.

These patterns also signal trend reversals that again help traders to enter or exit the market accordingly. Learning how to analyze a forex chart is a critical skill for anyone interested in trading forex markets successfully. The process of analyzing the chart begins with choosing the proper time frame. If you want to day trade you’ll choose a shorter time frame, perhaps one hour or less, but for momentum trades a longer time frame such as daily works best. You can also analyze the weekly chart to get a long-term picture of the market. Once you have the proper time frame your analysis is a matter of looking for emerging trends and technical patterns, as well as support and resistance levels.

The trend line signifies the overall uptrend of the pattern, while the horizontal line indicates the historic level of resistance for that particular asset. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions. Once an asset’s price falls enough, buyers might buy back into the market because the price is now more acceptable – creating a level of support where supply and demand begin to equal out. The Cup and Handle chart pattern helps you quite accurately anticipate pullbacks and trade according to the main rule of technical analysis, “Trend is your friend, trade with the trend”. The first and the most efficient patterns appeared exactly in the stock market on the only then existing time frame – the daily chart.

When developing quickly or over a long period of time, the bullish indicator isn’t as reliable. When this pattern develops, it often serves as a strong sign of a price movement continuation in the trending direction. Double bottoms, on the other hand, may signify that the price is about to trend upward. This pattern occurs during downtrends when the price finds resistance at the bottom and is unable to break down below it on two separate occasions.

Which pattern is best in forex trading?

Engulfing Pattern

While there are many candlestick patterns, there is one which is particularly useful in forex trading. An engulfing pattern is an excellent trading opportunity because it can be easily spotted and the price action indicates a strong and immediate change in direction.

Learn how to trade forex in a fun and easy-to-understand format. This seller consistently earned 5-star reviews, dispatched on time, and replied quickly to any messages they received. Needs to review the security of your connection before proceeding. The only difference between flag and pennant is, Flag looks like a small channel in a trend.

How to Use Chart Patterns for Trading

If you trade a symmetrical triangle, you should place a stop loss right beyond the opposite end of the breakout side. The pennant is a corrective/consolidating price move, which appears during trends. It resembles a symmetrical triangle by shape, as both are bound by trendline support and resistance lines. The difference is that pennants typically occur during a trend phase, while triangles can be formed during both trends and general consolidation periods. These are the chart formations which are likely to push the price toward a new move, but the direction is unknown. Neutral chart patterns may appear during trends or non-trending periods.

Does pattern trading work in forex?

Do Forex Chart Patterns Actually Work? By themselves, forex chart patterns do not work well at predicting the forex price chart.

Key roles include management, senior systems and controls, sales, project management and operations. Graeme has help significant roles for both brokerages and technology platforms. The information provided herein is for general informational and educational purposes only.

How many forex trading patterns are there?

There are three main types of chart patterns classified in Forex technical charting.