Content

Once the assets intermix it is significantly more difficult to track them precisely. If this happens, it can give an appearance that you are up to something dodgy if you get audited. It is best to find out what is required by your local government to make sure you are compliant. You can probably guess that this type of situation has arisen over and over again in the past and this is the reason why there are laws and regulations to prevent such an unfortunate situation.

- Commingling happens when the trustee or broker mixes their business or personal funds with the money held in the trust account.

- A trust account also referred to as an escrow, is an account set up to hold money for someone other than the account holder.

- The funds deposited in the trust account are received by a broker, salesperson, property manager, or the like on behalf of an individual , and are held in the performance of any acts for which a real estate license is required.

- A Property Management Agreement is a private contract and TREC is unable to advise you in private contractual matters.

- Notwithstanding the provisions of this chapter, a real estate broker may establish and maintain interest bearing accounts for the purpose of receiving deposits in accordance with the provisions of section 504B.178.

- Any rights that you have to terminate the contract will be contained in the contract.

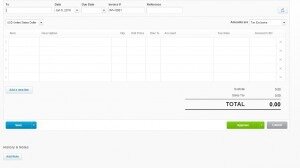

Trust accounts are mandated by various municipal entities, and often guided by specific state legislation. This review will delineate multiple areas where trust account types are required, and explain how they work and function within numerous real estate vocations and corresponding business relationships. Bank Directive on NSF Trust Checks – This form is required to be eligible for the spot inspection waiver program. A Broker-in-Charge/Firm seeking exemption would have to complete this form and give it to the bank where trust accounts are maintained. The form directs the bank to notify the Real Estate Commission when any item drawn on any trust account is presented for payment against insufficient funds. In the event the Commission receives notification of an NSF issue with a trust account, the Commission would proceed with an audit regardless of the fact that the exemption might have been obtained by the Broker-in-Charge/firm.

What is a trust account?

Yes, as long as the church member who made the referral receives nothing that may be defined as valuable consideration from the church or the license holder. If the business entity is a series LLC, you must include a copy of the Certificate of Filing from the Secretary of State’s Office with the Franchise Tax Account Status page. The Certificate of Filing must show that the business entity is a registered series of the business entity listed on the Franchise Tax Account Status page. To determine how many hours have posted to your license record, you may visit the license holder info search feature on our website.

Commingling is usually discovered during an audit of the company’s files. Most states require real estate brokers to conduct a monthly reconciliation of their trust account. A reconciliation is the process of cross referencing financial records. When a state licensing board conducts an audit construction bookkeeping they review reconciliations which make it easier to spot commingling. Even though the brokers have the power to pad trust accounts with funds to cover bank transactions and charges, it is unlawful to mix their money in the trust account, which is a violation of the real estate law.

Clients’ trust accounts

Remember that the trustee’s powers over the trust’s assets must be clearly stated in the trust documents. Schedule an appointment (Appointments are required for in-person services). LegalZoom provides access to independent attorneys and self-service tools. Use of our products and services are governed by ourTerms of Use andPrivacy Policy.

It is the process under which the funds or assets are transferred to a trust. If property ownership is not transferred to a trust, it cannot manage it. Review the brokerage firm’s office policy manual regarding the depositing of these funds into the brokerage firm’s trust or escrow accounts.

Common Risks of Incorrectly Setting Up Trust Accounts

In these instances, you must transfer your right to the property to the trustee. Mike is buying a house in Colorado with the help of his real estate broker, Keri. They are a private legal arrangement where one person’s https://www.globalvillagespace.com/GVS-US/main-features-of-bookkeeping-and-accounting-in-the-real-estate-industry/ assets are put in an account managed by someone else for their benefit. If you are going to open a trust account for your business, you must ensure you are meeting legal obligations for your state or territory.

DRE Hot Seat: Trust funds require constant upkeep – first tuesday Journal

DRE Hot Seat: Trust funds require constant upkeep.

Posted: Wed, 29 Mar 2023 07:00:00 GMT [source]

The „item covered“ entry may indicate a code number per chart of accounts, or may be documented by entry in a cash receipts journal, cash disbursements journal, or check voucher. Each broker shall maintain a pooled interest-bearing trust account for deposit of client funds. Each broker or closing agent shall maintain and retain records of all trust funds and trust accounts. The commissioner may prescribe information to be included in the records by appropriate rules. A trust protects both parties because it guarantees that all the funds are held safely until the closing or settlement.