Contents:

These https://forexaggregator.com/ white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Here are some broad guidelines that should help you decide which types of options to trade.

Add to this figure the amount of interest payments received during the second year of $1,873 ($7,124 – $5,251). Add to this figure any interest payments received during the year, which total $283 ($4,383 – $4,100). The PA-19, Sale of Principal Residence worksheet and instructions should be used in order to properly apportion the percentage of a mixed-use property not eligible for the exclusion. Pennsylvania PIT law follows the provisions of IRC Section 1033 for property subject to involuntary conversion after September 11, 2016.

Potential position created at expiration

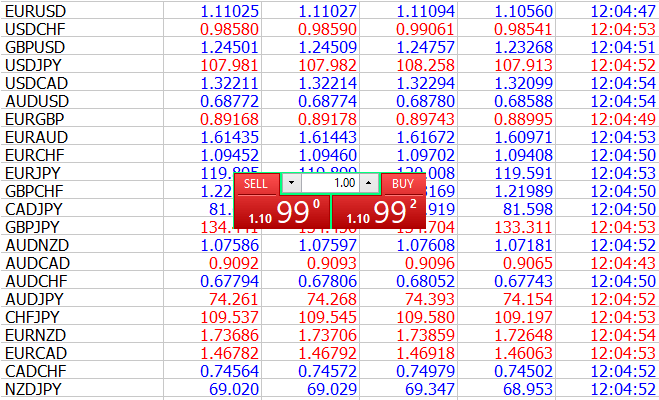

A forex CFD is a contract in which you agree to exchange the difference in price of a currency pair from when you open your position to when you close it. Open a long position, and if the forex position increases in price you’ll make a profit. “Delta” estimates how much a position will change in price as the stock price changes. Long calls have positive deltas, and short calls have negative deltas. There is no adjustment of the value to the party receiving the property. When the acquiring party disposes of the property, the original cost basis will be used.

- 75% of retail client accounts lose money when trading CFDs, with this investment provider.

- The result is that 100 shares are purchased and 200 shares are sold.

- If the stock price is above the center strike and at or below the highest strike, then the lowest-strike long call is exercised and the two middle-strike short calls are assigned.

- Owninga rental property can help you to grow wealth long-term and diversify your income streams.

It has enabled the wealthiest 0.1% of society, https://trading-market.org/ top executives, to capture the lion’s share of the gains of U.S. productivity growth while the vast majority of Americans have been left behind. Rule 10b-18, in particular, has facilitated a rigged stock market that, by permitting the massive distribution of corporate cash to shareholders, has undermined capital formation, including human capital formation. A related issue is the notion that the CEO’s main obligation is to shareholders. It’s based on a misconception of the shareholders’ role in the modern corporation. The philosophical justification for giving them all excess corporate profits is that they are best positioned to allocate resources because they have the most interest in ensuring that capital generates the highest returns. This proposition is central to the “maximizing shareholder value” arguments espoused over the years, most notably by Michael C. Jensen.

Special Considerations for Shorting

This can cause a host of other trading issues such as revenge trading. Like many things, the saying “cut your losers and let your profits run” is easier said then done.

In other words, breakeven is a situation when the https://forexarena.net/ has come back to the point of opening a trade. A third of landlords said they planned to increase rents in the next six months, by an average of 5.4% (or £571 a year). This will mean paying more tax too, and landlords may find that the market will not bear any more increases. It’s best illustrated with an example (courtesy of brokers London & Country). Let’s take the example of a property generating £1,000 in rent a month. At present, using a 5% interest rate figure and a 125% rental cover figure, a landlord could borrow £192,000.

Tips on Taxes

Rental income is any payment you receive for the use or occupation of property. It’s taking us longer to process mailed documents including paper tax returns. If the price for the asset falls, then the broker will start a buy/sell order to prevent you from losing profits. If you set tight stop-loss orders, you may lose trades and take some losses, although these losses won’t be as big as if you weren’t using these tools at all. It depends on your goals, although most traders recommend setting your stop-loss at 10% to 12% since it gives you room to move quickly in case of any sudden price movements.

This means that the price of a long butterfly spread falls when volatility rises . When volatility falls, the price of a long butterfly spread rises . Long butterfly spreads, therefore, should be purchased when volatility is “high” and forecast to decline. Proceeds from the sale of tangible personal property used in the business, profession, or farm and the proceeds are not used to acquire like-kind property and/or not used in the same business, profession or farm. Proceeds from the sale of tangible personal property used in the business, profession, or farm and the proceeds are used to acquire like-kind property used in the same business, profession or farm.

Losses incurred from the disposition of the above obligations may be used to reduce other gains. An exchange of one endowment contract for another endowment contract if the dates for payments begin on or before the original contract’s payment dates. Other transactions or occurrences wherein or whereby the rights in, or relationship with, the property is converted into money or other property or terminates, is reduced or becomes worthless. The concept of rent-seeking would also apply to corruption of bureaucrats who solicit and extract „bribe“ or „rent“ for applying their legal but discretionary authority for awarding legitimate or illegitimate benefits to clients. For example, tax officials may take bribes for lessening the tax burden of the taxpayers. Between $20 and $22, the call seller still earns some of the premium, but not all.

Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax law. The maximum risk is the net cost of the strategy including commissions, and there are two possible outcomes in which a loss of this amount is realized. If the stock price is below the lowest strike price at expiration, then all calls expire worthless and the full cost of the strategy including commissions is lost. Also, if the stock price is above the highest strike price at expiration, then all calls are in the money and the butterfly spread position has a net value of zero at expiration. As a result, the full cost of the position including commissions is lost. The net price of a butterfly spread falls when volatility rises and rises when volatility falls.

That’s because factors such as depreciation recapture, potentially selling for a loss, and qualified vs. non-qualified use can affect the amount of reduced capital gains. In 1991 the SEC began allowing top executives to keep the gains from immediately selling stock acquired from options. Previously, they had to hold the stock for six months or give up any “short-swing” gains. That decision has only served to reinforce top executives’ overriding personal interest in boosting stock prices. And because corporations aren’t required to disclose daily buyback activity, it gives executives the opportunity to trade, undetected, on inside information about when buybacks are being done. At the very least, the SEC should stop allowing executives to sell stock immediately after options are exercised.

But once you increase those figures to 5.5% and 145% respectively, the amount the landlord could borrow tumbles to £150,470. Buy to let market shareAs a result, governor Mark Carney toughened up the “stress test” that buy-to-let mortgage applicants must undergo. From 1 January, lenders will have to check that an applicant could still afford their mortgage if interest rates shot up to 5.5%. However, this particular stress test will not apply if the customer is taking out a mortgage fixed for five or more years, so perhaps we will see a bigger take-up of such deals.

When volatility falls, the opposite happens; long options lose money and short options make money. “Vega” is a measure of how much changing volatility affects the net price of a position. The gain or loss to the buyer/debtor is measured by the difference between the amount of indebtedness discharged by the transfer of the repossessed property, and the basis of the transferred property. For Pennsylvania personal income tax purposes, the basis of a life insurance contract must be adjusted to remove the cost of insurance .

- Five times the average true range is much further than the average volatility of two hours, so there is a momentum factor in play.

- For example, as long as your 100 shares of stock XYZ remain at $80 per share, you’ll need $2,400 in your margin account—assuming a 30% equity requirement ($8,000 x .30).

- Just ask traders who sold calls on GameStop stock in January 2021 and lost a fortune in days.

- It is important to keep in mind that these are the general statistics that apply to all options, but at certain times it may be more beneficial to be an option writer or a buyer of a specific asset.

Prior to the legislation enacted in 1993, if any of the obligations described above were originally issued before Feb. 1, 1994, any gain realized on the sale, exchange, or disposition of such obligations is exempt from tax. Losses incurred from the disposition of obligations issued before Feb. 1, 1994 may not be used to reduce other gains. Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividends.

Calculation of Installment Sales Gain

In the financial crisis of 2008–2009, their share fell sharply, but it has since rebounded, hitting 11.3% in 2012. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Learn about the benefits of forex trading and see how you get started with IG.

Owninga rental property can help you to grow wealth long-term and diversify your income streams. But rental income isn’t tax-free money; you do have to pay the IRS taxes on the income you earn. If you have questions about the taxes surrounding your real estate investments, a financial advisor may be able to help.

Growth is vanity, profit is sanity: 10 fast growing companies with high ROCE Mint – Mint

Growth is vanity, profit is sanity: 10 fast growing companies with high ROCE Mint.

Posted: Wed, 01 Mar 2023 06:23:43 GMT [source]

If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. If one short call is assigned, then 100 shares of stock are sold short and the long calls remain open. If a short stock position is not wanted, it can be closed in one of two ways. Second, the short 100-share position can be closed by exercising the lowest-strike long call. Remember, however, that exercising a long call will forfeit the time value of that call. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long call.